Why should You take advantage of the rates?

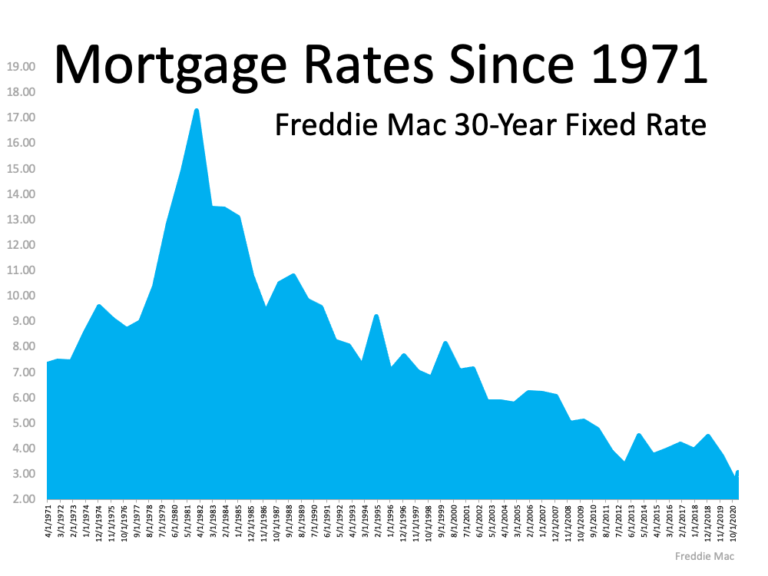

While mortgage rates are increasing this year, they are still extremely low when compared to the historical average. That being said any adjustment in the mortgage rate, on either end, has an effect on how much you can borrow to purchase your home whether good or bad. As Freddie Mac’s Chief Economist, Sam Khater, explains:

“Since January, mortgage rates have increased half a percentage point from historic lows and home prices have risen, leaving potential homebuyers with less purchasing power.”

How interest rates affect you?

When buying a house, it’s crucial to set a monthly budget so you can plan ahead and know how much you can afford to spend monthly. When it comes to sticking to a goal, even a slight rise in the interest rate will make a significant difference and therefore leave you at a disadvantage! So when it is time to purchase make sure you plan out a budget and be rigid about sticking to it.

What Interest Rates Do To Mortgage?

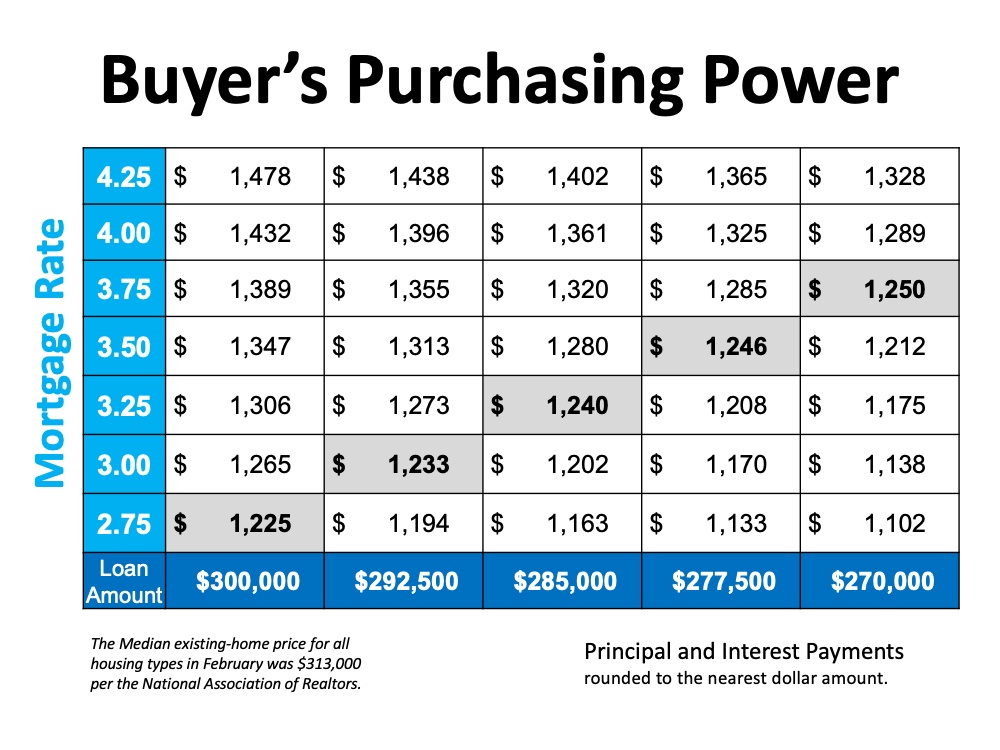

The median existing-home price today, according to the National Association of Realtors (NAR), is $313,000. Here’s an example of how a change in mortgage rate affects your monthly principal and interest payments on a home using $300,000 as a simple number similar to the median price.

If you’re getting ready to buy a house and know your budget provides for a monthly payment of $2000-2500, the loan sum must decrease every time the mortgage rate rises to keep your monthly cost in check. If you want to remain within your budget as mortgage rates increase, you may have to search for homes that are less costly. An effective yet plausible solution is to extend your commute by 20-30 minutes which could put you in a spot with less costly homes.

What To Expect In 2021?

Buying a home is already a stressful time in most people’s lives. Now take into account the ever-fluctuating mortgage rates and it can be tough. That it is more important now than ever to have a good team behind you (Lender, Agent, Title etc..) to help you get the results you de The sooner you can lock in those rates the better. In other words, closing on a home loan when mortgage rates are low allows you to borrow more money. This increases your buying power when it comes time to purchase a home. Mark Fleming, First American’s Chief Economist, explains:

“Monthly payments have remained manageable despite soaring home prices because of low mortgage rates. In fact, monthly payments remain below the $1,250 to $1,260 range that we saw in both fall 2018 and spring 2019, but they are on track to hit that level this spring.

Although they remain low, mortgage rates have begun to increase and are expected to rise further later in the year, thus affordability will test buyer demand in the months ahead and likely help slow the pace of price growth.”

The Truth

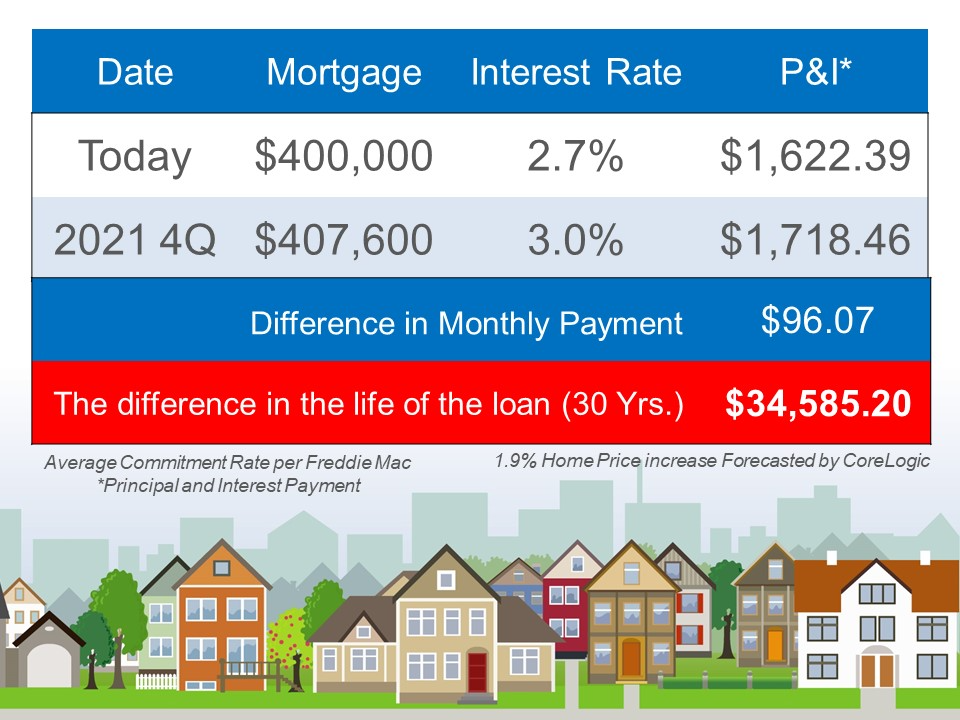

Here is what an increase of .3 % does to a 400k loan.

(Keep in mind this is only a representation of principal and interest. No taxes, insurance, hoa, or anything else simply principal and interest)

(Keep in mind this is only a representation of principal and interest. No taxes, insurance, hoa, or anything else simply principal and interest)

Mortgage rates are still very low today, but analysts expect that they will steadily increase this year. There has never been a time to buy like now and we might not see one for a very long time. As a result, every second counts for homebuyers who want to get the best mortgage rate possible so that they can afford their dream home.

Race To The Finish Line

The spring market is upon us and interest rates have ticked up. Although very obviously a seller’s market there may just be less competition with buyers getting priced out and forced to sit out. With the huge incentive of historically low-interest rates dwindling for now there may just be a chance to squeeze in your home purchase.