What Are Credit Scores Doing In The Market?

The average FICO® score on closed loans reached 753 in February, according to Ellie Mae’s most recent Origination Insight Study. Due to the recent tightening of lending requirements, many people are worried about whether or not their credit score is good enough to apply for a mortgage. Though tighter lending requirements may pose a challenge for some buyers, many will be surprised by the choices available.

Good News

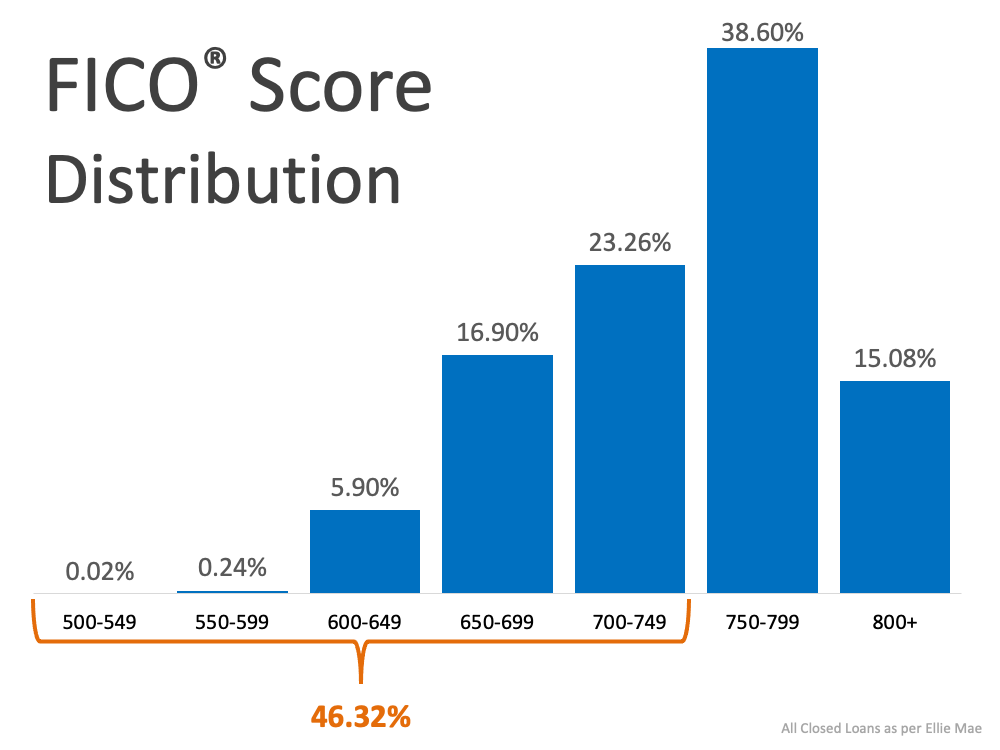

The fact that the average American’s credit score has improved in recent years is a positive indicator of financial health. As a person’s credit score improves, they’re putting themselves in a better financial position. If more Americans with good credit join the housing market, the FICO® score distribution of closed loans naturally increases, as seen in the graph below:

Don’t Be Scared

It’s quick to see this information and worry that you won’t be able to apply for a mortgage if your credit score is below 750. This is definitely not the case.

Although the majority of homeowners already have a credit score of at least 750, there is more to applying for a mortgage than a credit score, and there are still opportunities for those with lower credit scores to purchase their dream home. Here’s the deal although those stats say that most of the lenders that we work with will take as a little as 660 for an FHA Loan which is a far stretch from 750.

The Caveat

Although you can get a loan with a lower credit score, there’s no doubt a higher credit score will give you more options and better terms when applying for a mortgage, especially when lending is tight like it is right now so it wouldn’t hurt to have those credit scores. When planning to buy a home, speaking to an expert about steps you can take to improve your credit score is essential so you’re in the best position possible. However, don’t rule yourself out if your score is less than perfect – today’s market is still full of opportunity. Taking the right steps to improve your credit score is the best thing to do.

Misconceptions About Credit

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% f renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

With 75% of Americans being in the Good- Very Poor it’s no wonder there are many programs available with low or no credit score requirement.

The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 but most lenders add an overlay making it 660!

The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640.

Veterans Affairs (VA) loans have no credit score requirement. But like you might assume lenders do add overlays which are usually around 660.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year. FICO® reported,

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year. FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner.

Don’t let assumptions about whether your credit score is strong enough put a premature end to your homeownership goals. I have seen people immediately discount themselves for not being above 700 and the reality is you do not need it. The only way to know with certainty is to connect with a lending expert. Let’s connect today to discuss the options that are best for you